Thunder By The Numbers

$1200M+

$200M+

68K+

12K+

6K+

6,800+ Investors Actively Acquiring or Investing In Tech Companies

Apply to Thunder's network to publish your company to our network of 6,800+ investors, buyers, and sellers. Our AI-powered platform pinpoints ideal matches, facilitating M&A and capital-raise transactions. With over $1.2B in deals closed, we make the complex exit process simple and strategic.

M&A Advisory Services for Qualified Companies:

Exit with confidence. Our founder-led M&A advisory specializes in $5M–$100M tech transactions, ensuring founders get the best deal possible.

Strategic Assessment

We dig deep into your goals and market position, crafting an M&A strategy that maximizes your company’s value.

Target Identification & Outreach

Leverage our extensive network to connect with thousands of potential buyers, sellers, and investors.

AI-Powered Deal Matching

Our AI scans thousands of opportunities to pinpoint the best fit for your company.

Deal Structuring & Negotiation

We guide you through deal structuring and negotiations to secure optimal terms.

Due Diligence

Comprehensive DD support ensures you anticipate challenges and mitigate risks.

Roll-ups & Growth Buyouts

We help design and execute roll-up strategies or growth buyouts to scale efficiently.

Why Choose Thunder?

For Founders, By Founders

We're exited tech founders ourselves and have been through the founder journey to a successful exit. You get to leverage our experience, network, and tools to maximize a successful outcome for yourself.

.png?width=530&height=529&name=Group%206017%20(2).png)

Understanding

We’ve exited, acquired, and rolled up companies ourselves: we know the psychology of M&A firsthand. We know what it's like to juggle operations and manage team expectations and your board while trying to make a deal. It's lonely work, and we're your unbiased advisors that take a load off your shoulders.

Network

Gain access to 6,800+ investors, buyers, and growth-focused startups. We've done the hard work to establish a vast network and build the tech to save you from chasing the wrong investors.

Innovation

From identifying targets to managing investor outreach, our AI streamlines the M&A process, giving you an edge in a dynamic market. You save time, get more done, and get better results faster.

Experience

Our team of exited founders and investors have the experience to help advise you through what will likely be the most complex transaction you have or will ever experience. It's important to stack your team with people you have been in the arena before you and not just fans in the stands.

.png?width=530&height=529&name=Group%206017%20(2).png)

.png?width=530&height=529&name=Group%206017%20(2).png)

Completed Deals

.png?width=31&height=25&name=Vector%20(2).png) What the founder said

What the founder said

Before meeting Jason and the Thunder team, our company was preparing to raise a seed extension round, and we were feeling uncertain about navigating the fundraising process effectively. We engaged with Jason through an accelerator program, and from the very beginning, he was incredibly helpful. Jason assisted us in fine-tuning our pitch deck, ensuring that our story was compelling and our metrics were clearly communicated. He helped us establish a consistent cadence for investor updates, which was instrumental in keeping potential investors engaged. Moreover, he put together a comprehensive contact list of investors we should reach out to, significantly expanding our network. Throughout the process, Jason made everything run smoothly and professionally. He coached me on presentation skills and prepared me for the questions investors might ask, which greatly boosted my confidence. His expertise and personalized approach exceeded our expectations. Working with Jason and the Thunder team not only helped us successfully raise our seed extension round but also equipped us with valuable skills for future fundraising efforts. If you're a founder considering taking the next step but feeling unsure, I highly recommend working with Thunder. Their support can make a significant difference in your fundraising journey.

.png?width=31&height=25&name=Vector%20(2).png) What the founder said

What the founder said

Thunder was my secret weapon while fundraising. They supported me with key analysis to help close my debt financing. They gave great guidance on fundraising and created professional materials for my board and stakeholders. The team go above and beyond and deliver on what they say they are going to do. A very rare breed and a rare find. We will be working with them for the sale of our company without a doubt!

.png?width=31&height=25&name=Vector%20(2).png) What the founder said

What the founder said

Coming out of our raise I am more indebted to Jason & his team for all of their advice, guidance, and leaderships than anyone else. That's a big achievement given our scale.

.png?width=31&height=25&name=Vector%20(2).png) What the founder said

What the founder said

It’s rare that you come across a standout personality like Jason. I had the pleasure of working with Jason while scaling our company, Elude. As a first time startup founder, fundraising and working with investors is apart of the job. I wish everyone of our investors was as helpful and direct as Jason! Jason's responsiveness & willingness to help allowed us to close our pre-seed and seed stage investments quickly. He also provided invaluable advice on ways to build the business and stand out. Outside of the investment, he continues to go above and beyond and has assisted with multiple network introductions and additional investor connections. We're thrilled to have Jason apart of the team and strongly recommend founders to work with him! We're happy to have someone so diligent on our side :)

.png?width=31&height=25&name=Vector%20(2).png) What the founder said

What the founder said

I'm incredibly grateful for Jason. I knew I needed growth capital, but I had no idea how to get it. Jason made it so easy. His team handled all the document prep required, connected us to several lenders and secured us the absolute lowest cost of capital from a Tier 1 bank. And he did it all on time before our peak season ramp up. I plan to use Thunder for all our capital needs in the future

Meet The Team

Jason Kirby

Jason Kirby is a serial founder with 4 exits in the bag. He lends his expertise to guiding startups through acquisitions and has raised over $145M in transactions for Thunder founders.

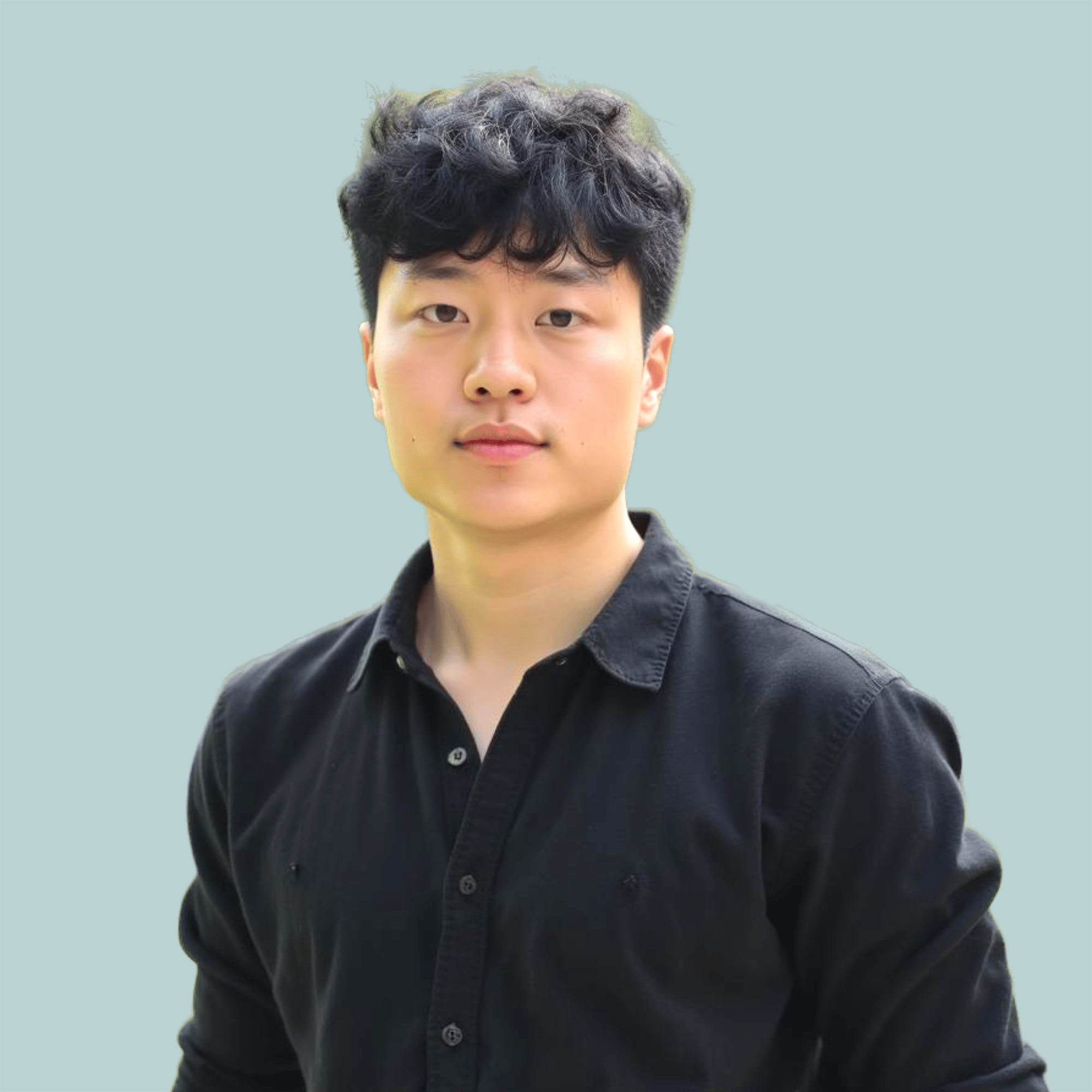

Oliver Low

Oliver is a Partner at Thunder. He is an experienced founder who has built and sold startups, initiated roll-ups, an IPO, and been part of a holding company.

Matt Sisco

Matt is a full-stack Data Scientist responsible for the Thunder platform development. Matt studied at Princeton and Columbia earning his PhD and specializes in advance statistics, machine learning, and large language models.

Ritu Khanna

Ritu brings 20 years of experience spanning JPM, Goldman, and Brookfield to power Thunder's investor relations.

Deep Gada

With over 9 years expertise in financial and valuation advisory, private equity, investment banking, and M&A Advisory, Deep's experience makes him a great financial advisor to the Thunder community.

Manoj Kumar

Manoj is a seasoned investment banking professional with 14 years of experience in deal support, competitive intelligence, relative valuation, industry/sector research, whitespace analysis, and end-to-end project management.

Ruth Nyakio

Ruth brings 5+ years of experience in venture capital to drive operational efficiency and strategic growth at Thunder.

Jason Lai

Jason brings his skills from strategy consulting, content creation, and being a founder/operator to fuel Thunder's growth

Payal Tawar

Payal is a financial analyst with 3 years in valuations and industry research. She is Thunder's resident expert on financial modeling.

Jatin Sharma

Jatin is a financial analyst with 3 years of experience spanning industry research, benchmarking, and translating financial data into actionable insights.

Ready to explore M&A?

Take the next step toward a successful exit.

Book a consultation today.