.png?width=285&height=242&name=qwe%20(1).png)

Screen

AI & human analysts will screen your top-of-funnel deal flow to save you time & money.

6,800+ VCs Already on Thunder

We use AI & human ingenuity to source, vet, and recommend direct investments and venture capital funds to family offices and HNWI opted into our network. Apply to join the network, it's free.

.png?width=160&height=100&name=01_alumni%201%20(1).png)

.png?width=160&height=100&name=01_alumni%201%20(2).png)

.png?width=160&height=101&name=01_alumni%201%20(4).png)

.png?width=160&height=101&name=01_alumni%201%20(5).png)

.png?width=111&height=63&name=Primary-logo%20(1).png)

.png?width=110&height=64&name=LV-Logo%20(1).png)

The Thunder Network

Join the 8,000+ founders, VCs, and investors that leverage Thunder’s vetted

network to access great deal flow and investors.

%201.png?width=90&height=90&name=undraw_investor_update_re_qnuu%20(1)%201.png)

LPs & Investors

Pre-vetted & curated deal flow of funds or companies direct to your inbox.

.png?width=117&height=125&name=Frame%206539%20(2).png)

Founders

Raise your next round with Thunder and let the investors come to you.

.png?width=118&height=125&name=Frame%206539%20(1).png)

VCs

Find your next investment or raise your next fund through Thunder.

400+ VCs Opted In

VCs leverage Thunder’s network to allocate and raise capital more efficiently.

LPs & Investors

Pre-vetted & curated deal flow of funds or companies direct to your inbox.

LPs & Investors to VCs

Investors, Family Offices, FoFs, LPs source and contact fund managers directly through Thunder.

LPs & Investors to Founders

.png?width=132&height=128&name=Group%205931%20(1).png)

Investors & Angels can source and contact founders directly through Thunder. Founders can only publish and update their profile to improve their matchability with investors.

How to Deploy Capital with Thunder

Save time and money by letting Thunder curate relevant deal flow

Active

Source deals & funds directly at no cost

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Thunder’s AI curates relevant deals for your review

Thunder’s AI curates relevant deals for your review -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Custom filters to narrow your results

Custom filters to narrow your results -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Directly review pitch materials for deals

Directly review pitch materials for deals -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Thunder screens and scores your deal flow

Thunder screens and scores your deal flow -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Reach out directly to companies or funds

Reach out directly to companies or funds

Passive

Access curated & vetted deals relevant to your mandates

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Thunder will send you hyper-relevant deals

Thunder will send you hyper-relevant deals.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Deals are pre-screened to your investment thesis

Deals are pre-screened to your investment thesis.png?width=25&height=26&name=bx_checkbox-square%20(1).png) You’ll have the option to deny, accept, or watch deals

You’ll have the option to deny, accept, or watch deals.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Your information is kept private and confidential

Your information is kept private and confidential

How Thunder Access Works

Network effect that curates deal flow using AI and human analysts

Startups & Fund Managers Apply

Thunder sources startups and funds to apply to the network by having them provide updated financials, pitch materials, and traction data.

Deals are Reviewed

Thunder’s analysts review deals to verify they’re venture-backable companies or reputable fund managers. If they pass our fundable criteria, they’ll be added to the network.

Browse & Receive Deals

Receive monthly digests of deals that meet your criteria, or log into your account to browse. Thunder’s team may suggest a specific company or fund that has undergone a more rigorous review and has been vetted and packaged up to raise quickly.

Choose to Connect or Pass

You’re in control of which deals are worth your time to connect or to pass. You can pass on a deal with no obligation to explain why. Thunder takes care of that for you.

Invest Directly

Thunder doesn’t interfere with your investment process, and you invest directly in deals you access through Thunder with no fees. You’ll just need to verify your accreditation, KYC/AML.

Apply to Join the Network

Submit your firm’s information to be reviewed and approved by the Thunder team.

Thunder is the easiest and fastest way to access deal flow outside your existing network.

Screen Your Inbound Deal Flow

Faster More Precise with AI

Let Thunder AI Process & Score Your Deal Flow

Let Thunder AI Process & Score Your Deal Flow

Forward your cold inbound email to a designated inbox and Thunder will analyze, catalog, and rate the deal flow according to your investment strategy. You’ll be notified via email of the best deals instantly but will have access to 100% of your deals to sort, filter, & manage at your leisure.

Deals are Scored Based on Your Investment Strategy

Deals are Scored Automatically Based on Your Investment Strategy

Thunder will understand the deals you’re looking for and go beyond sector/geo/stage to identify the intangibles. This info is used by the Thunder analysts and AI to recommend the best deals for you.

Annual Reports on Your Deal Flow

.png?width=370&height=325&name=Frame%206820%20(2).png)

Annual Reports on Your Deal Flow

Thunder will automatically process and aggregate the data around all of your deal flow in Thunder and highlight important KPIs to go into your annual reports for LPs.

Receive Curated Vetted Deal Flow

.png?width=312&height=284&name=Frame%206820%20(3).png)

Receive Curated Vetted Deal Flow

Join The Thunder Network 2,000+ Companies, 400+ VCs, and 350+ LPs & investors leverage Thunder’s vetted network to access relevant deal flow. APPLY NOW

Pricing

It’s free to join the network. Once in the network, you can upgrade to premium or be selected for Thunder's white glove services.

Access

Free

- Must be actively investing in funds or startups

- Access relevant curated deal flow for companies or funds

- Reach directly out to founders & GPs

- Receive tailored emails with relevant deals

- Profile & data is kept private & not shared publicly

- No fees of any kind

Tailored Deal Flow

Screening-as-a-Service

Popular

$500+/month

- Everything included with Access

- Dedicated account manager

- Quarterly 1-on-1 account reviews

- Screen inbound deals per your mandates

- Track, rate, & log all deal flow

- First access to premium deal flow through Thunder’s network

Sourcing & Screening Funds & Deals

Pricing

It’s free to join the network. Once in the network, you can upgrade to premium or be selected for Thunder's white glove services.

- Founders

- VCs

- Investors

Get Started

Just Apply & Create a Profile

Free

-

Get your benchmark score to see your ranking

Get your benchmark score to see your ranking -

Access your list of relevant investor matches

Access your list of relevant investor matches -

Get in front of investors

Get in front of investors -

Investors can contact you if interested

Investors can contact you if interested -

Update your profile anytime to get the latest matches

Update your profile anytime to get the latest matches -

Access to exclusive community events and offers

Access to exclusive community events and offers

Premium

Quarterly Commitment

$59/mo

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Everything included in the free plan

Everything included in the free plan -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Download a CSV of your investor matches with contact info

Download a CSV of your investor matches with contact info -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Request investor intros directly on the platform

Request investor intros directly on the platform -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Access more data & insights on each investor

Access more data & insights on each investor -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Access & download a list of the portco founders of the investors you matched with

Access & download a list of the portco founders of the investors you matched with -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Generate an investment memo to pass along to investors

Generate an investment memo to pass along to investors

- Network Access

- White Glove Service

Get Started

Just Apply & Create a Profile

Free

-

Get your benchmark score to see your ranking

Get your benchmark score to see your ranking -

Access your list of relevant investor matches

Access your list of relevant investor matches -

Get in front of investors

Get in front of investors -

Investors can contact you if interested

Investors can contact you if interested -

Update your profile anytime to get the latest matches

Update your profile anytime to get the latest matches -

Access to exclusive community events and offers

Access to exclusive community events and offers

Premium

Quarterly Commitment

$59/mo

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Everything included in the free plan

Everything included in the free plan -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Download a CSV of your investor matches with contact info

Download a CSV of your investor matches with contact info -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Request investor intros directly on the platform

Request investor intros directly on the platform -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Access more data & insights on each investor

Access more data & insights on each investor -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Access & download a list of the portco founders of the investors you matched with

Access & download a list of the portco founders of the investors you matched with -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Generate an investment memo to pass along to investors

Generate an investment memo to pass along to investors

Allocate

Tailored Deal Flow

Free

-

Must be an active VC currently allocating capital

Must be an active VC currently allocating capital -

Access relevant curated deal flow

Access relevant curated deal flow -

Receive tailored emails with relevant deals

Receive tailored emails with relevant deals -

Reach out to founders directly

Reach out to founders directly -

Profile & data is kept private & not shared publicly

Profile & data is kept private & not shared publicly

Raise

Warm Intros to LPs

1.5%+*

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Must apply and be approved

Must apply and be approved -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Receive coaching on your fund positioning to family offices

Receive coaching on your fund positioning to family offices -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) LP meeting coordination

LP meeting coordination -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Warm intros to relevant LPs

Warm intros to relevant LPs -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Investor verification

Investor verification

- Network Access

- White Glove Service

Allocate

Tailored Deal Flow

Free

-

Must be an active VC currently allocating capital

Must be an active VC currently allocating capital -

Access relevant curated deal flow

Access relevant curated deal flow -

Receive tailored emails with relevant deals

Receive tailored emails with relevant deals -

Reach out to founders directly

Reach out to founders directly -

Profile & data is kept private & not shared publicly

Profile & data is kept private & not shared publicly

Raise

Warm Intros to LPs

1.5%+*

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Must apply and be approved

Must apply and be approved -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Receive coaching on your fund positioning to family offices

Receive coaching on your fund positioning to family offices -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) LP meeting coordination

LP meeting coordination -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Warm intros to relevant LPs

Warm intros to relevant LPs -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Investor verification

Investor verification

Access

Tailored Deal Flow

Free

-

Must be actively investing in funds or startups

Must be actively investing in funds or startups -

Access relevant curated deal flow for companies or funds

Access relevant curated deal flow for companies or funds -

Reach directly out to founders & GPs

Reach directly out to founders & GPs -

Receive tailored emails with relevant deals

Receive tailored emails with relevant deals -

Profile & data is kept private & not shared publicly

Profile & data is kept private & not shared publicly -

No fees of any kind

No fees of any kind

Screening-as-a-Service

Sourcing & Screening Funds & Deals

$500+/month

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Everything included with Access

Everything included with Access -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Dedicated account manager

Dedicated account manager -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Quarterly 1-on-1 account reviews

Quarterly 1-on-1 account reviews -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Screen inbound deals per your mandates

Screen inbound deals per your mandates -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Track, rate, & log all deal flow

Track, rate, & log all deal flow -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) First access to premium deal flow through Thunder’s network

First access to premium deal flow through Thunder’s network

- Network Access

- White Glove Service

Access

Tailored Deal Flow

Free

-

Must be actively investing in funds or startups

Must be actively investing in funds or startups -

Access relevant curated deal flow for companies or funds

Access relevant curated deal flow for companies or funds -

Reach directly out to founders & GPs

Reach directly out to founders & GPs -

Receive tailored emails with relevant deals

Receive tailored emails with relevant deals -

Profile & data is kept private & not shared publicly

Profile & data is kept private & not shared publicly -

No fees of any kind

No fees of any kind

Screening-as-a-Service

Sourcing & Screening Funds & Deals

$500+/month

-

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Everything included with Access

Everything included with Access -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Dedicated account manager

Dedicated account manager -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Quarterly 1-on-1 account reviews

Quarterly 1-on-1 account reviews -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Screen inbound deals per your mandates

Screen inbound deals per your mandates -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) Track, rate, & log all deal flow

Track, rate, & log all deal flow -

.png?width=25&height=26&name=bx_checkbox-square%20(1).png) First access to premium deal flow through Thunder’s network

First access to premium deal flow through Thunder’s network

FAQs

Have a question that you don't see answered? Don't hesitate to reach out to help@thunder.vc

Who is Thunder designed for?

Thunder is designed for three key investor profiles:

-

Venture Funds: VCs Thunder to access a broader range of deal flow, keep track of emerging sectors, and discover vetted, high-quality opportunities aligned with their investment strategies.

-

Family Offices: Thunder acts as their due diligence and deal flow arm, providing access to direct investment opportunities without fees, making it easier to invest in direct deals.

-

High Net-Worth Individuals: Thunder helps HNWIs discover innovative founders and projects that align with their interests and strategic goals.

How does Thunder work for investors?

There are no fees for investors to participate or invest directly on a company's cap table.

Investors engage with Thunder in two ways:

-

Active Engagement: Upload your investment thesis and criteria to the platform. Thunder then connects you with relevant opportunities based on your preferences.

-

Passive Engagement: Thunder delivers fewer, highly-tailored, and vetted deals directly to you, focusing on quality and fit.

What types of companies and deals are on Thunder?

Thunder predominantly works with B2B and B2C technology companies, spanning software and hardware. Deal stages range from pre-seed to pre-IPO. For companies that Thunder works with, transaction sizes usually range from $5M to $50M.

How does Thunder help with due diligence?

Thunder ensures that the companies presented to investors are "transaction-ready," meaning all key information is packaged and easily accessible. This approach minimizes back-and-forth and makes for a smoother investment process.

How does Thunder make money?

While all tools and services are free for investors, Thunder charges issuers (companies raising capital) a small transaction fee when a deal closes.

Is Thunder a registered broker-dealer?

Yes. Thunder operates through Jason Kirby, a registered representative with Stonehaven LLC, a FINRA-registered broker-dealer. All investment communications are conducted by licensed professionals.

Thunder X Capital, LLC offers securities through Stonehaven, LLC, a Member of FINRA/SIPC. Regulatory disclosures: Disclaimers & Risks, Privacy Policy and Form CRS.

How do I get started?

Simply create a profile, upload your investment thesis, and start browsing or receiving matched deals. Once you find an opportunity that interests you, connect directly with the founder to learn more and begin the investment conversation.

How do Thunder's algorithms work?

Thunder uses proprietary algorithms to match investors with opportunities based on their investment thesis and preferences. These algorithms prioritize quality and relevance, helping you find the right deals faster.

What sets Thunder apart from other platforms?

-

No Fees for Investors: Thunder offers free access to direct investments without any hidden charges.

-

Tailored Deal Flow: Thunder delivers high-quality, vetted deals that align with your unique investment preferences.

-

Streamlined Due Diligence: Companies on Thunder are ready to transact, saving investors time and effort.

What kind of communication should I expect from Thunder?

You’ll receive two types of deal notifications:

-

Founder Outreach: Founders that match your thesis can send targeted outreach directly to you via our platform.

-

Thunder Vetted Deals: Occasionally, we’ll send thoroughly diligenced, investment-ready deals to your email. These are high-quality opportunities vetted by our team.

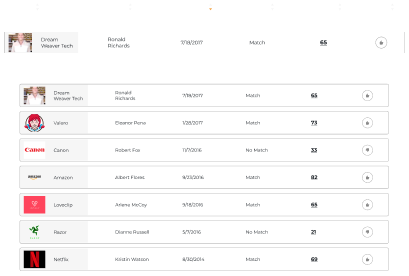

How We Get Deals Scored

Company Scores

Thunder’s AI calculates a dynamic company score using a logistic regression model, which is recalculated constantly as we add, update, and remove companies. This bell-curve approach reflects the reality that investors typically focus on extreme outliers—the companies most likely to be funded. However, our Match Scores ensure a balanced system, keeping unlikely matches open to level the playing field and create more opportunities for companies to connect with the right investors.

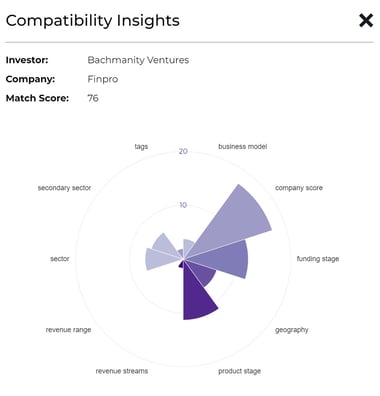

Match Scores & Quality Matches

Thunder’s AI assigns a Match Score to every potential investor-company connection, factoring in variables like stage, sector, location, revenue, product adoption, and more to identify the best fit.

-

75% of companies have at least one qualified match.

-

64% of companies have at least five qualified matches.

-

54% of companies have 15+ qualified matches.

Investor Score

Thunder tracks investor velocity on a quarterly basis to predict the likelihood of investment activity.

%201%20(1)-1.png?width=296&height=228&name=undraw_agreement_re_d4dv%20(2)%201%20(1)-1.png)